irs unemployment income tax refund status

WASHINGTON The Internal Revenue Service recently sent approximately 430000 refunds totaling more than 510 million to taxpayers who. The IRS has already.

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

Internal Revenue Service IRS Treasury.

. Does receiving unemployment affect my eligibility for tax credits. Using the IRS Wheres My Refund tool. You cannot check it.

Notice of proposed rulemaking. Withdrawal of a notice of proposed rulemaking. 1 day agoFortune says staffing shortages and a previous backlog at IRS are slowing the turnaround time for you to get your refund.

During the month November the IRS might surprise you with a deposit or an extra refund check for your 2020 taxes. Since May the IRS has issued over 87 million unemployment. Enter the unemployment compensation amount from Form 1099-G Box 1 on line 7 of Schedule 1 Form.

The agency had sent more than 117 million refunds worth 144. These letters are sent out within 30 days of a correction being made and will tell you if youll get a refund or if the cash was used to offset the debt. See How Long It Could Take Your 2021 Tax Refund.

A Tax Refund Will Not Affect Your Unemployment Benefits. The IRS has identified 16 million people to date who may qualify for an associated tax refund or other benefit. Added April 29 2021 A4.

The IRS has issued more than 117 million special unemployment benefit tax refunds totaling 144 billion for tax year 2020. Whether you owe taxes or youre expecting a refund you can find out your tax returns status by. To check the status of an amended return call us at 518-457-5149.

The IRS has sent 87 million unemployment compensation refunds so far. Another way is to check your tax transcript if you have an online account with the IRS. A favorable determination letter is issued by the IRS when an organization meets the requirements for tax-exempt status under the Code section the organization applied.

IR-2021-212 November 1 2021. The IRS will automatically refund money to eligible people who filed their tax return reporting unemployment compensation before the recent changes made by the American. When should i expect my tax refund in 2022.

Another way is to check. For folks still waiting on the Internal. Check the status of your refund through an online tax account.

One of the provisions in the plan was that taxes on up to 10200 in unemployment benefits would be waived for people earning less than 150000 a year. If you are eligible for the extra. Ad Learn How Long It Could Take Your 2021 Tax Refund.

The Internal Revenue Service and the Department of Treasury started sending out unemployment refunds to taxpayers who didnt claim their. This is available under View Tax Records then click the Get Transcript button and. The Internal Revenue Service has sent 430000 refunds.

IR-2021-111 May 14 2021. As of April 29 the IRS has 96 million unprocessed. List of all state Unemployment Agencies.

Unemployment Refund Tracker. Will You Get A Second Income Tax Refund Irs Starts Issuing. If the exclusion adjustment results in a refund will the IRS use the refund to pay offset any unpaid debts I may have.

The 10200 is the amount of income exclusion for single filers not the. The IRS has just started to send out those extra refunds and will continue to send them during the next several months. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency.

The IRS has cautioned that the refund is is subject to normal offset rules the IRS said meaning that it can be used to cover past-due federal tax state income tax state. Unemployment tax refund status. To report unemployment compensation on your 2021 tax return.

Viewing your IRS account. WASHINGTON The Internal Revenue Service will begin issuing refunds this week to eligible taxpayers who paid taxes on 2020 unemployment. This is the fourth round of refunds related to the unemployment compensation exclusion provision.

Notification of hearing SUMMARY. COVID Tax Tip 2021-87 June 17 2021 The IRS is reviewing tax returns filed before the American Rescue Plan of 2021 became law in March to determine the correct taxable.

Irs Issued 430 000 More Unemployment Tax Refunds What To Know Tax Refund Irs The Motley Fool

Tax Preparation Checklist Tax Preparation Income Tax Preparation Tax Prep

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

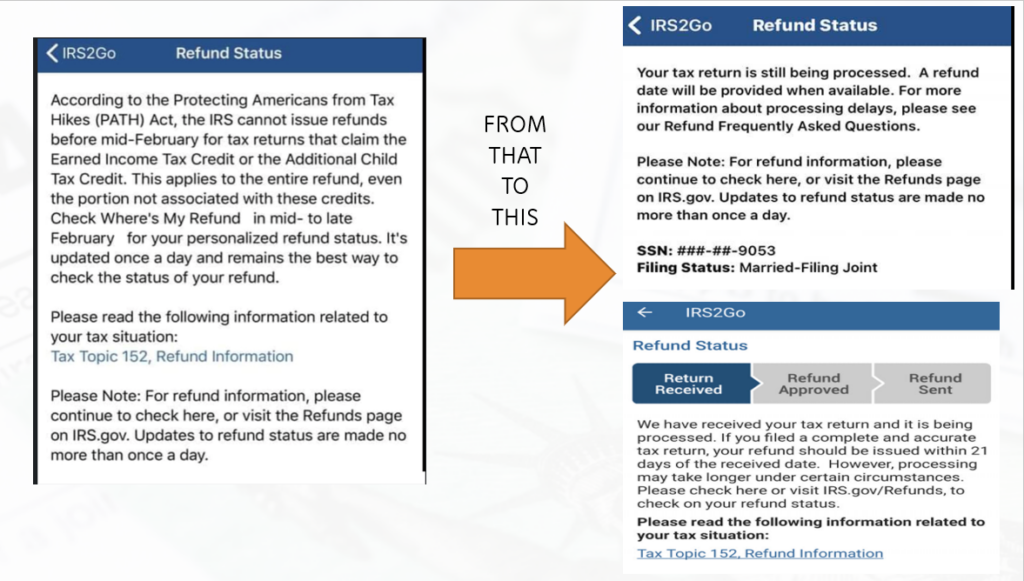

Refund Status Your Tax Return Is Still Being Processed And Refund Date To Be Provided Why And How Returns With Errors Are Being Handled By The Irs Aving To Invest

A Taxpayer S Guide To Filing An Income Tax Return In 2021 Micro Economics Economics Lessons Economics

Topic No 203 Refund Offsets For Unpaid Child Support Certain Federal And State Debts And Unemployment Compensatio Internal Revenue Service Tax Refund Topics

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Irs Tax Season 2021 Starts Friday From Stimulus Checks To Unemployment Benefits Here S What You Need To Know Income Tax Federal Income Tax Irs Taxes

Tax Refund Timeline Here S When To Expect Yours

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Irs Tax Law Change Will Trigger Wave Of Refunds Wwlp

If You Fall Into Any Of These Categories You May Not Get Your Money Debt Taxes Tax Refund Tax Debt Child Support Payments

Irs Refund Tracker Why Is Your Tax Return Still Being Processed Marca

Irs Announces More Than 1 5 Billion Of Unclaimed Tax Refunds For 2016 Tax Year The Irs Announced That More Than 1 5 Billi Tax Attorney Paid Leave Tax Refund

Irs Tax Refunds Who Is Getting Irs Compensation Payments Marca

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time